Financial Planning

Good, holistic financial planning is not only about planning for the expected transitions and the known risks, but also for the unexpected and unknown so that you can have peace of mind. It’s where conventional planning ends and we go further. Because at Foundation Family Wealth money is the tool for a meaningful life. A life that is about more than just money and peace of mind. A life that is about living on purpose and the experiences and dreams you want to live. We make that happen.

ELEMENTS OF FINANCIAL PLANNING

|

|

|

|

|

HOW DO WE DO FINANCIAL PLANNING?

We start with your story and what you have now. We also take the time to understand what values drive you and then help you articulate what your vision is. This holistic approach is strategic, consolidating the facts, insights and goals into a detailed financial plan that empowers you with its step-by-step approach, towards goal-realisation.

The financial planning process follows the globally recognised steps of covering all the bases – your cash flow, investments, taxes, risk planning and insurance needs, and ends with what should happen on your death. It covers all the known transitions like retirement and death but also plans for the unknowns and assumptions going wrong.

Every financial plan offers a decision-making framework, tools, and outlines the basis of an ongoing relationship which includes review processes and access to ongoing expertise.

WHAT CAN YOU EXPECT FROM THE PLANNING PROCESS?

We believe that we cannot help you make good financial choices without having a holistic understanding of our clients. Our financial planning process, therefore, includes four phases:

1. Introduction

Our first meeting is for you to understand what we are about, our planning process and whether we are the right financial planners for you.

2. Discovery

We then proceed to understand your story, beliefs about money and goals, in addition to understanding your income and expenses, savings and investments. We use our own discovery tools to help you think through your vision for your future and identify what we need to plan for.

3. Planning

In an interactive planning meeting, we work through scenarios and strategies with you, using world-class technology to illustrate the potential outcomes and probability of success of different strategies. We talk through investment options and risk management plans. We then present the agreed, holistic and detailed strategic plan including how to minimise your tax and plan for your death. At this juncture, you choose whether you want to adopt the strategic plan, allow us to implement it for you and choose Foundation Family Wealth to become your future financial partner.

4. Implementing

We then proceed to implement the financial plan. It’s all about taking the load off you so that you can get on with your life. We are a paperless, technology driven-business. Everything happens digitally. Everything is about making life easy for you.

The planning process will give you a road map for your future, a decision-making framework and peace of mind that we’ve covered all the bases. It will require that you invest time and energy upfront so that we can form a solid foundation for the future. But it will be time and energy well spent.

HOW WE CHARGE

Financial planning

The first introductory 30-minute consultation is free.

For the initial financial planning process and the financial plan, we charge a professional planning fee. The fee varies between R14 950 incl. VAT and R24 950 incl. VAT, depending on the complexity of the work required and the time we will invest in the process.

This initial investment of time and money in the financial planning process on the client’s part shows that the financial planning process has value, as it establishes the foundation on which clients will build. It also recognises that the planning process is not a sales process.

We do not sell financial products, nor are we compensated for facilitating transactions on clients’ behalf. Our only source of income is the fees that our clients pay us for initial planning and ongoing financial partnership.

We also don’t charge any upfront fees, performance fees, transaction-based fees, or commissions on investments.

Ongoing financial partnership

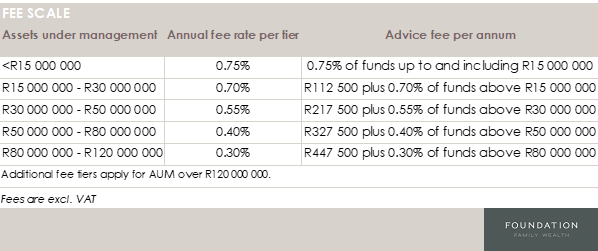

For an ongoing financial partnership, we charge a fee based on the size of the assets, which is deducted from client assets.

The fee covers all our contact with you but will include at least one thorough annual review of your financial planning progress. It also includes reviews when your circumstances change.

Our team implements all the investment decisions, and dedicated team members are assigned for ongoing support. We take the administration burden of your financial planning ff your hands.

We will report to you regularly and stay in contact through our insightful and relevant communications to keep you updated on matters which may impact your financial situation.

Because we offer a personalised, holistic service, we apply an annual minimum fee of R50 000 incl. VAT.

Our ideal clients are those who share our philosophy and are eager to embark on a thoughtful financial planning journey with a long-term financial partner. We cater to clients with investable assets of R5 million or more, as well as those on the trajectory to reach this level soon. As we encourage multi-generational planning, we will apply family pricing for extended families.

Consultation

Some individuals may find it beneficial to consult with us without engaging in the financial planning process or ongoing financial partnership. This typically applies to those who are starting out or seeking advice on a specific issue.

Consultation fees:

R2 500 incl. VAT per hour for a financial planner.

R4 500 incl. VAT per hour to consult with a senior financial planner.