Wealth Analyst Thiart van der Merwe writes the first article in our series on general financial planning for yuppies. Thiart is passionate about the everyday decisions we make, and how these affect our futures much more than our investment returns.

Many young professionals can’t wait to put their first paycheck towards a fancy car. Most of us want the vehicle our friends will envy. But, what we don’t realise is that it generally comes hand in hand with a six-year-long down payment that could’ve been spent more wisely. It may seem small at first but in the long-term it’s an investment guzzler.

So, what if we decided to buy a less flashy car – whether we’re starting out or upgrading every five years? The kind that fits our budget at the time?

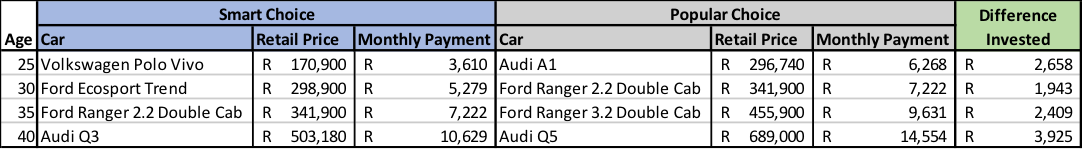

I’ve done an analysis on this below, and assumed we invest the difference into a balanced investment to return 7% (above inflation). In this analysis I’ve assumed the following “smart choices” instead of the more popular choice.

I’ve also assumed that from the age of 40 onward you continue driving a car in the range of a Audi Q3 instead of the range of a Audi Q5.

If you had invested this difference throughout your lifetime you would have R5 million (in today’s money) at the age of 60. This is a considerable amount that can go a long way to fund your retirement.

The staggering thing about this analysis is that I did not select bottom of the range cars as the “smart choice” at the given age; I merely chose the car that would fit a certain age bracket and showed you that if you just wait to buy that dream bakkie or BMW - how beneficial it could be in the long run.

The more astonishing analysis comes when you are content with driving a car in the class of the Ford Ecosport, or any car in the R300K range - for the rest of your life. If this were the case you would have saved R7.5 million by the time you reach the age of 60. To put that in perspective, that would be the price of a four-bedroom home in a popular Johannesburg suburb like Northcliff or Parkhurst.

This is a bit of a minefield: there are a number of arguments to support buying certain pricey cars with their great service plans etc. If you do decide to purchase an expensive car and drive the said car for 20 plus years that’s a great decision. But, few people actually do that: they walk out of the dealership with their “popular choice” car, only to replace it with a brand new one within the next five years.

As a young professional the ball is in your court and it’s up to you to make smart financial choices. You are never too young to start saving and as Albert Einstein said: “Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.”