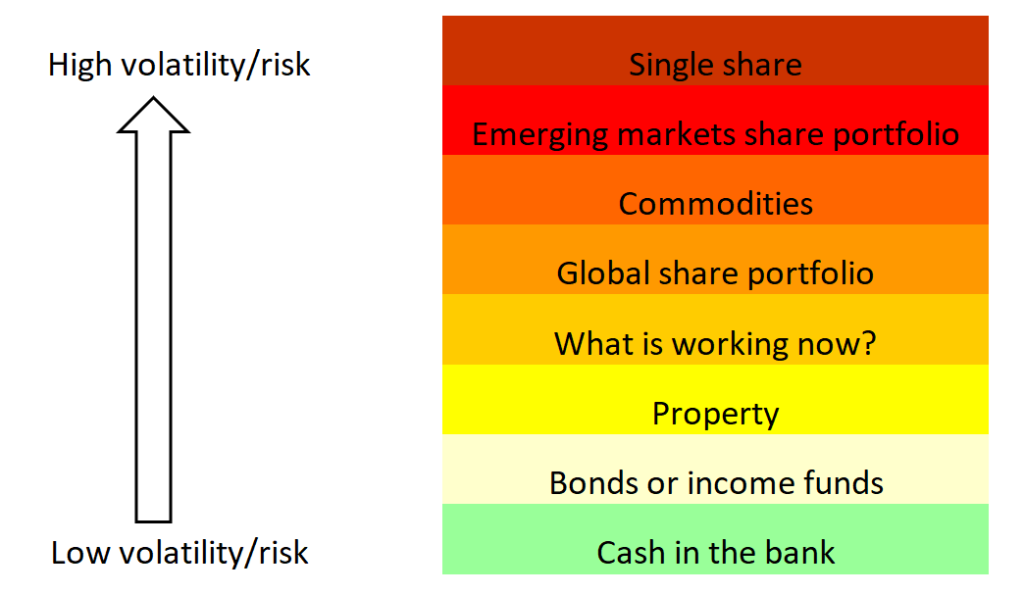

The financial industry loves things that can be measured and calculated because it can explain or justify any decision. So, when it comes to determining the “riskiness” of an investment the industry typically calculates the standard deviation or volatility of an investment – in other words, the variance between returns. An asset with high volatility will produce returns that vary wildly year on year. If we use these measures to rank asset classes from low risk to high risk, the results are as follows:

Source: Foundation Family Wealth

Risk is therefore, something that can be measured, and we, regardless of understanding the measurements, use it to make investment decisions.

The problem is, we think we are concerned about risk, but we are not. Humans are much more concerned about uncertainty!

The difference is that you cannot measure uncertainty.

Given our preference for managing uncertainty as supposed to risk, we find that measurements like volatility is not very useful. The more volatile an investment, the more possible outcomes there may be. However, this does not affect the likelihood of those outcomes. Turbulence on a plane is not pleasant for anyone, but more turbulence does not affect the likelihood of a crash.

Volatility, like turbulence, can be unsettling in the short term but for most long-term investors it is not the biggest concern. Your biggest concern is ensuring you arrive safely at your destination, which in investment terms means having enough money.

So, what are the biggest uncertainties investors should be worried about?

Permanent loss of capital

This is the single biggest risk you will face as an investor. Losing capital can seriously impact your overall financial planning and wellbeing.

Avoiding losses is not always possible, but there are things you can do to reduce your risk of losing capital.

- Diversify your investment portfolio. Even if one investment loses all its value, it will not endanger your overall wealth.

- Stay away from things that come and go. Things that seem to work now but may not work in the future. These often don’t have long track records or can be based on some tax loophole or temporary occurrence. Good examples of this now – cryptocurrencies and some 12J structures.

- Be wary of investments that “guarantee” you something. What are you giving up in return?

- Understand your goals and objectives well. With a short-term goal, you can tolerate lower risk.

Stick to your investment strategy. Do not sell when there is panic. You will lock in losses, which may be prevented by keeping your long-term strategy.

Inflation

This is the most underrated and underestimated risk.

Have you ever tried walking UP the DOWN escalator? Even if you haven’t, you’ll know that you need to walk much faster than the escalator if you want to reach the top. This is exactly how inflation works. So, how do you protect yourself against inflation?

- Diversify your investment portfolio.

- Invest in growth assets (a turbulent ride that will get you to your destination faster).

- Take a long-term view of investments.

- Stick to your strategy.

- Manage your spending.

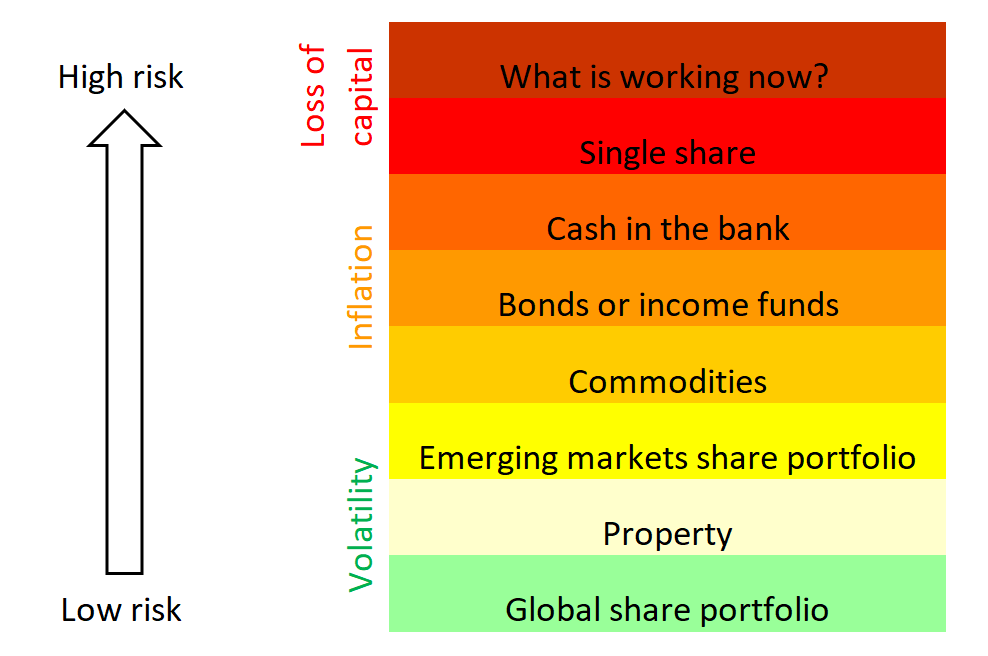

Understanding the link between risk and uncertainty means we can rank asset classes differently, which ultimately impacts the way we do portfolio construction.

Source: Foundation Family Wealth

For example: A well-constructed global share portfolio that offers good diversification should be regarded as a “low” risk investment over the long-term.

As Nobel prize winner Harry Markowitz noted in his ground-breaking paper on portfolio risk, if shares do not move in tandem (and they do not), a portfolio’s risk can be lower than the risk of the individual single shares. Owning a combination of different shares and asset classes will provide you with protection against the unknown. Think of a toothpick. It’s easy to break one toothpick, but try and break 20 of them together? Not so easy!

At Foundation we know that the only certainty is uncertainty. Together we focus on a few important things that are in our control.

- Diversification

- Managing your spending

- Managing your behaviour

These basic principles, together with our rigorous financial planning process and portfolio construction, make our clients’ financial journey easier and more comfortable. We might not know what will be coming next, but regardless of what life throws at you, our aim is for you to succeed.