Taxes for the wealthy have been rising steadily in recent budgets. This year was no different. The budget had one overriding theme – make the wealthy pay. The top tax rate is now 45% for those earning above R1.5million and for trusts. In addition, dividend tax increased to 20% from 15% with immediate effect.s:

http://www.treasury.gov.za/documents/national%20budget/2016/guides/2016%20Budget%20Highlights%20Card.pdf and the new tax guide http://www.treasury.gov.za/documents/national%20budget/2017/sars/Budget%202017%20Tax%20Guide.pdf

Although capital gains tax inclusion rates have not changed, the new marginal tax rate has effectively increased the capital gains tax rates for top earning individuals. There was some relief for lower income earners and the elderly. Those over 75 can now earn up to R131,150 plus R34,500 interest before paying tax. In addition, transfer duty on properties below R900 000 will now be exempt from tax (previously R750 000). In addition, from 1 March 2017 loans to trusts will attract 8% interest per year. This tax will be payable by the lender. The 8% interest will be deemed a donation, and will attract donations tax of 20% each year. The minister also announced that attempts to avoid this tax by extending loans to companies owned by trusts would be curbed by extending the scope of the anti-avoidance measures. The trend is clear – high earners and high net worth individuals will pay more tax.

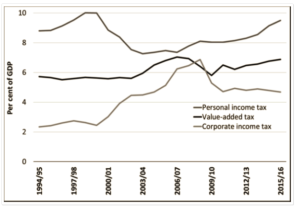

Source: Treasury What to do about all these taxes?

- Review your family’s trust:

The minister announced that the anti-avoidance measures should be reviewed to exclude trusts that are not used for estate planning purposes such as certain trading trusts. All other trusts, especially those with large outstanding loan accounts should be reviewed. Trusts used only for estate duty purposes with large outstanding loan accounts are almost certainly no longer viable. However, the trustees should consider the purpose of the trust.

- Review your retirement planning:

In order to retire comfortably, you should save around 15-20% of your pre-tax income every year. The new annual limit of R350 000 tax deductible contribution, means that all those earning above R1.75 million could fall short of this savings target. Retirement vehicles (pension and provident funds, preservation funds and retirement annuities) have added tax advantages – there is no tax payable inside these vehicles until you retire. Even after retirement, you only pay tax on your income from these vehicles. This is a huge advantage, given the high personal and dividend tax rates. If you are willing to forego the access to your money until age 55 and you make savings outside these vehicles, you should consider contributions above your tax-deductible limit. All tax-deductible contributions and growth on those are also exempt from estate duty.

- Consider endowments

Who would have thought that old-fashioned endowment policies could make a comeback? They are back in vogue. Endowments have had a special tax dispensation for decades – all income tax is payable inside the structure at a flat rate of 30% and 12% on capital gain, which makes them attractive to individuals with a higher marginal tax rate. Modern endowments are see-through and even cost-effective. It also saves you the time and money to account for taxes. You should however be cognisant of liquidity constraints within the first 5 years.

- Unit trusts

Collective investment schemes such as unit trusts are also proving more attractive. Investments into unit trusts are made with after-tax funds and there is income and dividend tax payable by unit holders whether distributed or not. There is no capital gains tax payable in the unit trust. Unit holders are only taxed on the gains once units are sold. Portfolio managers can therefore make changes within the portfolio without it attracting capital gains tax.

- Company structures could be attractive

Company tax is now significantly lower than tax on trusts. There are still costs involved in maintaining a company which will only make it attractive for large investment portfolios. However, the benefit of a company structure is that dividend tax is only payable when a dividend is declared. Therefore, tax can be delayed until you require funds from the company. You will need expert advice to determine whether this structure is for you. We work closely with many accountants to work out the best alternative for our clients. Where is tax going? Economic growth has structurally declined in South Africa. Current government policies do not inspire confidence with consumers or business. It is unlikely that tax revenues, which are dependent on economic activity will increase sufficiently so that Treasury can reduce personal taxes in the near future. Furthermore, it suits current political leadership to blame economic woes on inequality and the past and it seems they believe that the wealthy should pay to eradicate inequality. In addition, the lack of skill at SARS coupled with pressure to increase tax recovery has caused friction between taxpayers and SARS. It will pay to keep tax affairs in order and uncomplicated. Lengthy disputes with SARS are proving to be costly. Tax should never determine your choice of investment portfolio. You should start with your needs and the return and portfolios required to meet those needs. Only then, should you consider the appropriate vehicle to minimise tax. Talk to us about the tax efficiency of your portfolio.