-By Elke Zeki

This debate is on-going and some are very passionate about it. In the South African market, quality active managers have been relatively successful in outperforming equity benchmarks over the long-term. However, recent low returns from the market (and active managers) has brought a renewed interest in passive solutions from investors. Why is this, and should we change our approach?

Passive

A passive investment strategy is a fund that merely tries to replicate a certain index as closely as possible over time. Because the constituents and construction methodology of most indices, like the ALSI Top 40 are made available, a simple strategy is for a portfolio to exactly replicate this.

What passive solutions are available to South African investors?

Exchange Traded Funds (ETF) – a marketable security listed on the stock exchange that tracks/replicates an index.

Market capitalisation-weighted Exchange Trade Funds – an ETF that replicates an index whose individual components are weighted according to their market capitalisation (value of company’s outstanding shares). The larger companies carry a larger percentage of the fund.

Smart Beta Exchange Trade Funds – a type of ETF that uses alternative index construction rules instead of the typical cap-weighted index strategy, in a transparent way. It considers factors such as dividend yield, value and volatility.

Passive Unit Trust Funds – Like an ETF, but a unit trust fund that is not a listed instrument and therefore only available through LISP platforms or directly through the service provider.

Active

Active investment management, on the other hand, is a style of investing where the portfolio/fund manager aims to design a portfolio that will outperform the fund’s benchmark or index. The selection of shares and the weight of the shares will therefore differ from the index in an attempt to produce a superior result.

A brief recap of some of the arguments:

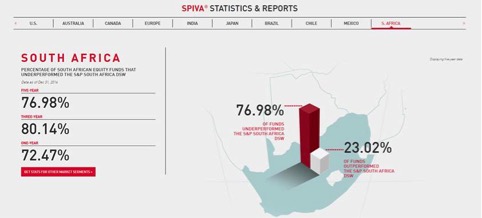

Although we are lagging in comparison to the rest of the world, we are expecting South Africa to experience a similar trend for the following reasons:

- The strategy provides a low-cost option to gain investment exposure to a broad and diversified market.

- Increasing competition in the passive space should lead to lower costs.

- Because of costs and general efficiencies in financial markets, it’s difficult for active managers to consistently outperform benchmarks. We have seen evidence on this over the past five years. See link to recent global study.

In its review of retirement funding costs over the last few years, National Treasury has come out in support of passive funds, saying they are underutilised in South Africa.

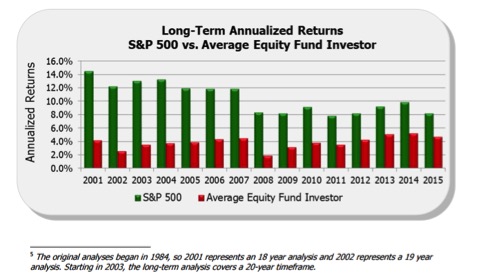

Another very important factor to consider is investor behaviour.

When it comes to investment returns and performance - most investors are their own worst enemies. Investor behaviour is the biggest detractor of returns as shown by Dalbar studies (Quantitative Analysis of Investor Behaviour- www.dalbar.com).

Investor behaviour is not simply buying and selling at the wrong time: it is the psychological traps, triggers and misconceptions that cause investors to act irrationally. That irrationality leads to the buying and selling at the wrong time which leads to underperformance of the available market returns.”

Illustrated below:

Low returns play a part

Even though many of these arguments are not new to investors, we believe that the interest in passives has accelerated due to lower recent equity market returns investments and sensitivities around fees.

Over the past three years, the South African equity market has moved sideways. Higher management fees are therefore questioned in an environment where equity markets returned only 5.9% annualised compared to the long-term average of 13%.

Graph from Investec Asset Management

What we've learned?

Investor behaviour impact long-term investment returns more significantly than choosing between active and passive.

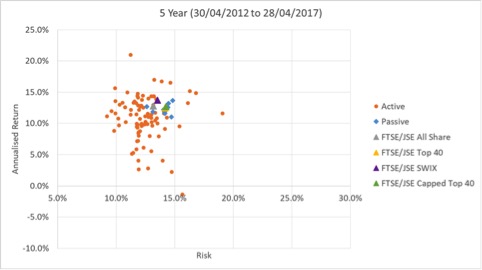

Good South African fund managers produce similar returns to passives or indexes over the long term, but they take significantly lower risk.

Source: PortfolioMetrix

Outperformance by good fund managers is not always consistent and can be “lumpy”. It’s therefore important to stick with a selected fund manager through good and bad times.

Both styles have merit. The most suitable one will depend on personal preferences and goals. There is a case for blending these approaches as we can address the following specific issues more efficiently:

- Reduce overall costs – especially if there is a targeted fee.

- Reduce concentration risk.

- The continuing growth of the South African ETF market and the introduction of new ETF’s will ultimately lead to even lower costs and provide more choice.

- Uncorrelated returns to some degree if you blend passive market cap index with an active manager that is benchmark agnostic and construct a portfolio based on valuations.

- As the market develops, we believe there will be space for true active managers.

At Foundation, we strive to find solutions for every client based on their personal needs and objectives. We continue to innovate, based on rigorous research and careful consideration. We will continue to choose or develop new products for our clients so that they can benefit from these developments.

Also, through a disciplined approach, we want to help investors to avoid irrational, destructive, decisions based on short-term performance.