By Elke Zeki

I heard a great analogy the other day from world-renowned researcher and storyteller, Brene Brown. She explained how often Thought and Behaviour sit in the back while Emotion drives the car. There are few things in life that stir up emotion the way money does. Even experienced investors are at risk of letting their emotions overtake their judgement – often without even realising it.

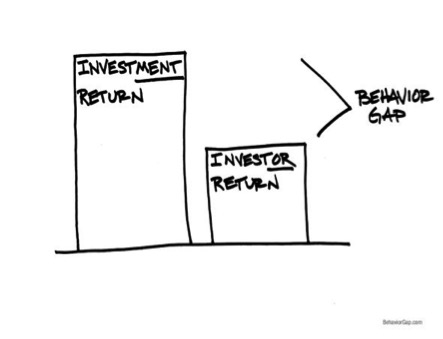

This behaviour can have a significant impact on long-term investment returns. The world’s biggest study in this field, The Dalbar study (http://www.qidllc.com/wp-content/uploads/2016/02/2016-Dalbar-QAIB-Report.pdf), shows that the average investor in the US gets much lower returns than the market/index. Why is that?

Research in psychology has identified a range of decision-making behaviours called biases. These biases relate to how we process information and how that leads us to making a decision. Without realising it, these biases can lead to poor investment decisions that destroy value over time. The only way to combat this is to understand what biases there are and the effects they may have on your decision-making. By doing this you may be able to reduce their influence and learn to work around them.

In times where markets are in turmoil and returns are low, we as financial advisors, often see strong influences from these biases when dealing with clients. These are some of the most prominent biases to be aware of:

Anchoring or confirmation bias

This is when you are fixated on one salient point and you ignore all the other information available to you. Or you only pay attention to information that supports your opinion.

Any of these look familiar?

- Looking at past performance.

- Only reading articles or research that supports your view.

- Only considering the cheapest option.

- Still holding an underweight equity position due to the financial crisis in 2007/08.

- Believing that you predicted the low market return because of your political view.

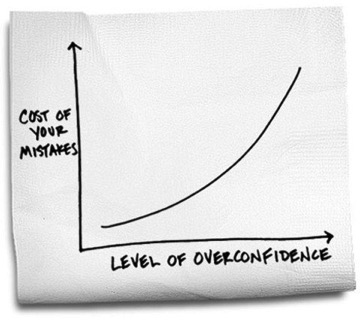

Confidence bias

Most people tend to be overconfident in their own abilities. Just ask anyone if they think they are an above average driver? This is particularly prevalent amongst investors. Any investor that enjoyed short-term success based on their own decisions will claim the credit. However, if something goes wrong they see it as bad luck or blame someone else. This bias deeply entrenches perception and therefore may cloud your judgement. Interestingly, research show that men are often more overconfident than women.

Any of these look familiar?

- Trading often.

- Believing that you can pick winning investments and therefore keeping a high exposure to a specific stock or investment.

Familiarity bias

You have preference for familiar investments despite being “expensive” – or your portfolio is lacking diversification.

Any of these look familiar?

- Holding Naspers at 25% of the portfolio because it has done well and you’ve had it for 10 years.

- Not wanting to invest in hedge funds or international shares because its unknown and outside of your comfort zone.

Loss aversion bias

This bias refers to our tendency to avoid losses over acquiring gains. We feel the pain of loss more deeply than the joy of gain. This often leads to investors being too conservative.

Recognise any of these?

- Not wanting to sell a losing share to avoid confronting the fact that it was a poor decision, despite the fact that funds can be reinvested into a share with a potentially better future.

- Preferring money in the bank over investments where there is a larger potential gain such as equities.

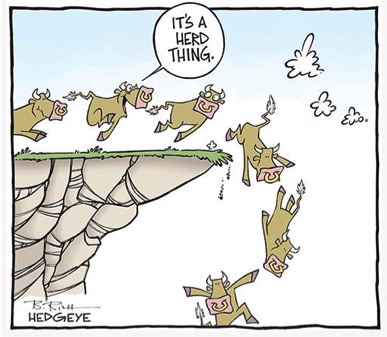

Bandwagon effect or herding bias

Humans are social beings and there is a deep desire to be part of a group or community. This behaviour drives investors to follow trends or other peers. This is a powerful bias as it can impact investments more than any other bias – due to the momentum it creates. Following the crowd often means buying when prices are high and selling when prices are low.

What about these?

- Buying IT shares during the DOT.com bubble (2001)

- Taking large portions of your wealth offshore at R16/$1.

- Investment returns that are too good to be true but all your friends are investing in it.

- Invest in Bitcoin, it’s the next best thing! (We aren’t against this – just beware.)

Recency bias

With this bias, investors have the tendency to assume future events will be similar to their current experience. Thus, they attach more value to recent information than any older information. This is bias can be especially risky during bull markets when there is an assumption that markets will just continue going up.

Any of these look familiar?

- Wanting to go with overweight equities because the markets have rallied well recently.

- Investing in Bitcoin because its returns have been so strong.

How do you avoid these biases?

Here are some important things to take into account when making investment decisions:

- Make sure your investments are well diversified.

- Take a long-term view. It is time in the market that matters, not timing the market.

- Be disciplined with your investment approach and rebalance regularly. Rebalancing protects you from judgement errors.

- Fundamental bottom-up research helps avoid expensive/bubble assets.

- Identify your specific goals and objectives – this will help identify suitable investments.

It’s true that these biases also affect investment professionals, not only investors. However, in most cases investment professionals put processes in place to combat potentially destructive behaviour. Investors don’t always have the same awareness, knowledge or infrastructure to protect themselves.

We therefore believe it’s crucial to work with a trusted financial advisor. As objective and independent advisors at Foundation Family Wealth, we help clients stick to their financial plans so that they achieve their long-term goals. We hold up the mirror when making investment decisions through uncertain times so that they can see when they are falling prey to biases. Sometimes this means doing something against your natural bias. Sometimes it just means doing nothing. Our advice is backed by sound and sophisticated research and most importantly it is always done with our client’s best interest at heart.