Your retirement and the retirement of your money are separate events. You do not need to retire from your retirement fund at the same time as your own retirement, and you can retire from your fund before you retire.

When can I retire from my funds?

Age 55 is the time from which you can retire from your retirement fund. Whether you have access to your money, depends on the type of retirement fund you contribute to. If that fund is a condition of your employment at the time, you may not retire from that fund until you leave that job. You may then be contributing to a pension or provident fund and you will need to continue to contribute until you retire, resign or are retrenched.

However, if you are contributing to a retirement annuity, you may retire from your annuity any time from 55. There is a caveat! If you are still contributing to an old style annuity, one that you signed to keep contributing to for a fixed period, you may be liable for penalties and fees – and you might not be able to get out of it until the maturity date of your annuity.

Of course, if you are contributing to a more modern, flexible annuity, you can stop or change your contributions at any time. You can take a contribution holiday and start again when you need or want to. (As an aside, you can possibly change from those old annuities, sometimes without cost – to a more flexible, cost effective annuity. Talk to Foundation if you would like an analysis of your annuities.)

If you have a preservation fund – as a result of previous contributions to an employers’ fund – you may also retire from these funds at any time after 55 regardless of your employment.

What are your choices on retirement?

On retirement, you can draw a third of your pension, retirement annuity or pension preservation fund in cash. You can draw your entire provident fund in cash (although the government wants to change this). The first R500 0000 of your lump sum withdrawal, is tax-free. Thereafter, the Receiver will take their share according to a tax table. See below.

With the rest of your retirement funds, you must buy an annuity that should ideally give you a regular income stream for the rest of your life.

Why would you delay retiring from your retirement fund?

It is tempting to get your hands on a large lump sum at 55. Sometimes it is necessary to fund plans for another career or a new business. But, it’s important to mention: It is equally tempting for those financial advisers who earn (a fat) commission on selling products to try and convince you to buy an annuity after turning 55.

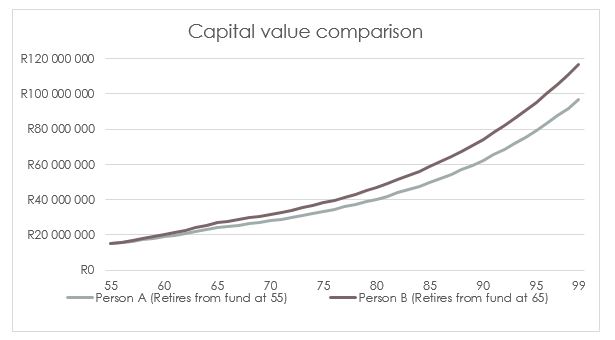

If you do not need the money, it is rarely advisable to retire from your retirement funds at an early age. The reason is simple: the power of compounding. The longer you can leave the funds to grow inside a retirement fund, tax free, the better. Let’s look at this graph as an example:

When you retire from your retirement funds, taxes will devour a large part of your savings. Since it is compulsory to buy a life annuity from which you will receive a taxable income or living annuity – you must draw at least 2.5% every year and you will pay tax on the income withdrawals.

In the graph above, we illustrate the difference in the capital value of a retirement fund between Person A who retires at age 55 and withdraws 2.5% per year but re-invests the funds (so the person is still working and living off a salary), and Person B who retires at age 65 and starts withdrawing then.

Of course, the tax on your lump sum will also diminish you savings immediately.

When does it make sense to retire early from retirement funds?

There are times when it makes sense to retire earlier from a retirement fund and it relates to accessing the lump sum. When your retirement assets are a large part of your assets, access to liquidity is sometimes a challenge. For example, if a family wants to increase their direct offshore exposure to protect their assets against political risk, they may choose to retire early from their retirement funds providing they can afford to.

When do I need to retire from my retirement funds?

There is no longer a compulsory retirement age. You can delay retirement from your retirement funds indefinately. That is, if you can afford to.

As of 1 March 2018, a person will be able to transfer a pension or provident fund to a retirement annuity once the member has reached retirement age (The Taxation Laws Amendment Act, 2017). There will be no tax consequence. The full value of the retirement interest will need to be transferred and can’t be staggered. Should you transfer the provident fund to a retirement annuity you will lose the liquidity benefit of withdrawing 100%.

It is likely that you will also be allowed to transfer your pension or provident fund to a preservation fund at retirement (waiting for formal announcement).

This makes sense if you have other income sources or accept another job after you have retired from your employer’s pension or provident fund.

Can I continue to contribute to a retirement annuity after I have retired?

You can now contribute to a retirement annuity after your retirement even if you no longer earn a salary. It makes sense if you earn more income than you need. You can deduct your contributions from your taxable income up to the 27.5% of your taxable income to a maximum of R350 000 per year.

Deciding when and how to retire from your retirement products can be complicated. It should not necessarily determine when and how you retire though. At Foundation, we help our clients through this minefield. We are also not commission driven – nor do we make money from advising you to buy a new product. This puts us in a place where we can help you through the process by offering advice that is in your best interests. We can show you the impact of your decisions to retire earlier or later through thorough analysis. You can therefore make better decisions for your future.

Foundation Family Wealth is an Authorised Financial Services Provider.