In this series of articles, we’re giving you the advice you need on how to set yourself up for financial freedom. Our aim is to give you practical steps each month – action points that you can take immediately. Follow these steps over the course of the series and you will be set up for financial wellness.

Our second article focuses on property and the investment case. Most of you have probably been advised something like: “Property is the only investment you will ever need to make. Buy a flat, it’s passive income. The flat will pay for itself if you rent it out. Property is always a great investment because you have a physical building.” We could go on but you get the idea. We believe it is not that straightforward. No investment is a certainty and no investment is that simple. Here are some insights and potential pitfalls you should be aware of.

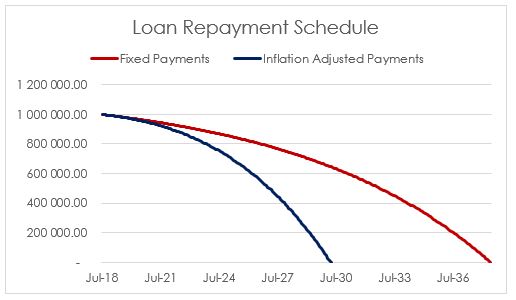

Before we start, here’s the most important piece of advice and action you can take this month: For any type of property or in fact anything you financed, we implore you to adjust your payments annually by your pay increase. Right away, don’t wait for a month. Assuming you only get an inflationary increase (5%), bump up your monthly installment by the same percentage. On a R1 million mortgage at 10% the graph below shows that you can pay off your loan in just under 12 years – that’s 8 years faster than sticking to the original installments.

For those out there who struggle to save a portion of their income – buying a house is probably the best thing you can do. Not because of its investment prowess, but mainly because it forces you to SAVE. Not a lot of people will skip a mortgage payment as the bank will be there soon to take your property back. In that sense, the forced discipline created makes for a great investment tool.

If you are one of those who have managed to portion out a part of your income to save, I’d suggest a more diversified approach to investing. You don’t want all your eggs sitting in two flats in Rosebank Johannesburg because it’s the next best thing.

Below we state the case not to buy an investment property.

What is an investment property?

A property you bought in order to generate an income (through a tenant) or by selling at a later stage for a profit (capital appreciation) – is considered an investment property.

In our example you buy a property and borrow R1 million at the prime lending rate (10%). You will pay off the bond over 20 years at roughly R9 650 per month.

The counter scenario would be to invest R9 650 monthly into a very conservative fund such as an income fund. This fund has a 92% allocation to income generating instruments (cash & bonds) and 8% to property – a conservative, low risk fund just to make this point.

The South African Housing Index shows that since January 2000 house prices have grown in real terms (after inflation is taken into account) by only 3.2% per year. The fund in our example grew 5.4% above inflation since its inception date (July 2001). View the performance figures here.

Investing R9 650 monthly into the fund would mean that your investment in 20 years would be worth R4.1 million in today’s money. Paying off your bond would mean you own a property worth just under R2 million in 20 years’ time.

Let’s assume you get a tenant. You use the rental income after levies, maintenance and potential months of vacancy to furnish your bond. In most instances there will be a shortfall, which you will need to cover. Let’s assume the shortfall is R3650, which means your net income from the property is R6000 a month.

Investing only R3 650 a month would leave you with R1.6 million after 20 years (in today’s money).

We are trying to illustrate that property is not the only investment that is worth your while. You might argue that the monthly net income is higher than R6000 or that property growth in the right areas is much higher than that. We will argue that we did not take into account transfer costs or taxes and could have used a higher risk equity fund with a return of 7.5% above inflation.

Saving into a diversified unit trust fund or even Exchange Traded Funds (ETF’s) can be just as effective as buying property. It is also much less stressful and easier to access your money than selling a physical building.

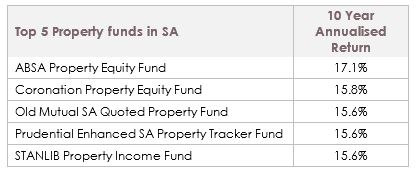

There are guru’s out there that know how to pick the right property in the right location with the right tenant. However, most young people will have one shot at buying one investment property. This is risky – a high rise building could block your sunny flat, tenants could wreck your property or economic fundamentals in your area can deteriorate for reasons out of your control. If you really want property, rather look at buying into a property fund. Professionals who invest in property for a living. Some of them have yielded exceptional long-term results.

Source: Stanlib Weekly Focus

Action points for the month

- Increase your bond payment with the same percentage as your salary increase as soon as it happens.

- If you do decide to buy a property, do your homework and ensure you get the best price.

- Ensure that you lock down a decent interest rate for your bond – shop around with different banks.

- If you are hesitant about property, open a flexible investment. You will reap the rewards in the long term.

In closing some advice from the one and only Warren Buffett that could be applied to property as well: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.” Eloff Street, the most expensive piece of land in the famous Monopoly game has deteriorated significantly in value over the last 20 years – not a lot of people saw that coming.

Foundation Family Wealth now offers a consultation service for young people who are serious about money. Contact thiart@foundationsa.com to find out more.

<Foundation Family Wealth is an Authorised Financial Services Provider>