In this series of articles, we’re giving you the advice you need on how to set yourself up for financial freedom. Our aim is to give you practical steps each month – action points that you can take immediately. Follow these steps over the course of the series and you will be set up for financial wellness.

Our fourth article focuses on buying a car. This topic is close to my heart as I believe this is the single biggest reason people are indebted for life with no material investments later in life. Let me explain why…

You start out your professional career around 25, and one of the first things you do is browse through websites of cars ready to make your first substantial purchase with your own money. You immediately dream of the sleek 1 Series BMW or that Double Cab bakkie that will make you the talk of the town. You-Only-Live-Once right? The problem is you have no deposit and a ska-donk as a trade in if you are lucky. You commit to a five-year loan to pay off your flashy new car – and suddenly hefty monthly installments eat away at your salary and you are indebted for the near future.

In our analysis we ask the question: What if I start small and delay my ideal car purchase by five years. We then assume you SAVE the difference between the monthly payment you would have paid and the actual payment.

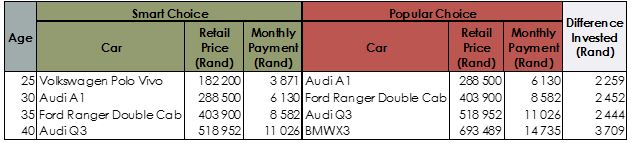

The table below illustrates our thinking.

As you can see, we just delayed the dream car for five years. From the age of 40 we assume you keep buying a car in the range of R500 000. Investing the difference into a portfolio that targets growth of 7% (after inflation) is likely to result in a considerable portfolio worth R5 million at the age of 60 (all in today’s money). The only change you need to make is your mindset about delaying the purchase of your dream car.

If you have the discipline to drive a car in the range of the Audi A1 (R300 000 purchase price) for the rest of your life and invest the difference, you can build an investment of R8 million at the age of 60, which can provide you with income of R30 000 a month in your retirement years.

It is part of our culture to assess someone’s wealth by the car they drive and thus we are all a part of this rat race to buy the most expensive car. If you could steer clear of this and rather invest by choosing the Smart Choice you could set yourself up for financial freedom at a much earlier stage of your life.

The ball is in your court and it’s up to you to make the smart financial choices. You are never too young to start saving. As Albert Einstein said: “Compound Interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t, pays it.”

<Foundation Family Wealth is an Authorised Financial Services Provider>