Planning for retirement can be challenging as there are many unknowns and uncertainties that you need to consider. There are a few financial risks that can have a significant impact on your capital and your ability to draw income comfortably for the rest of your life.

What are these risks and how do we deal with these challenges?

Not saving enough

This is the biggest risk you face. A recent Sanlam Survey (find the link here) shows that most South Africans don’t save enough money for retirement. The average savings rate is 7% versus the suggested minimum savings of 15%. The result is that retirees expect market returns to make up for the shortfall. Market returns are unpredictable, and this is an unreasonable expectation.

What can you do?

- If you are young or have young children – encourage an early start.

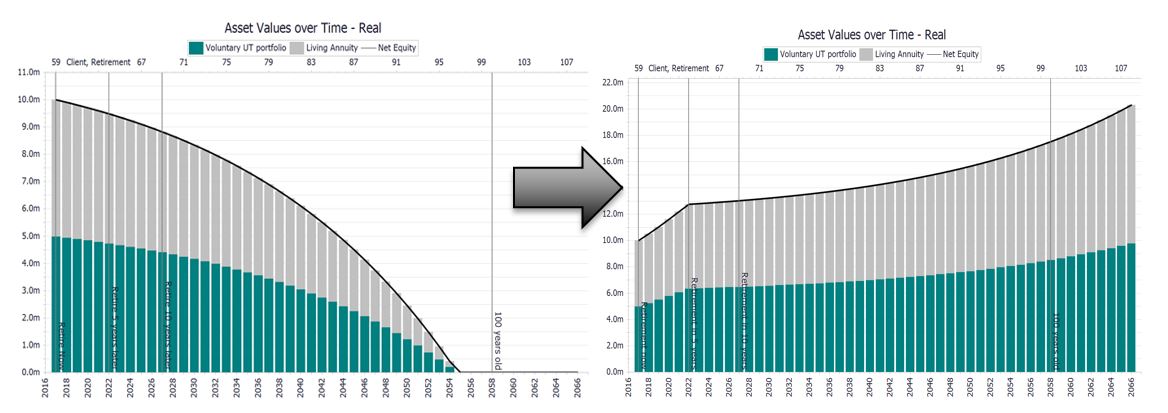

- Postpone retirement.

Assuming no further savings, a balanced portfolio and 6% drawdown, the example below shows the impact on our client’s capital if he postpones retirement by five years. The impact is significant! Instead of the capital declining over time, it’s possible to protect and even grow the capital.

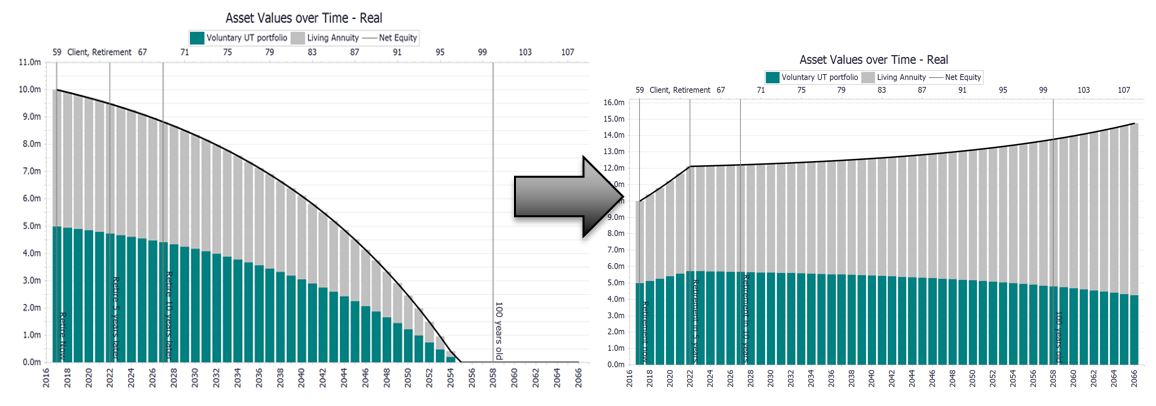

- Earn some income.

Assuming no further savings and a balanced portfolio, the example below shows the impact on our client’s capital if he draws less than 6% for the first five years. He supplements his income through consultation or part time work. Again, the impact is significant!

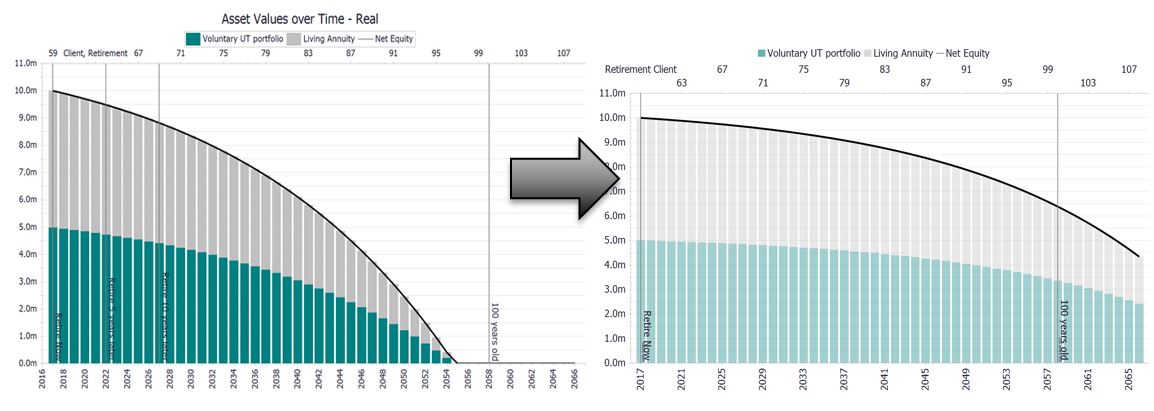

- Reduce drawdown.

The example below shows the impact on our client’s capital if he reduces his income drawdowns from 6% to 5.4% per annum. It’s possible to extend the lifetime of your capital significantly.

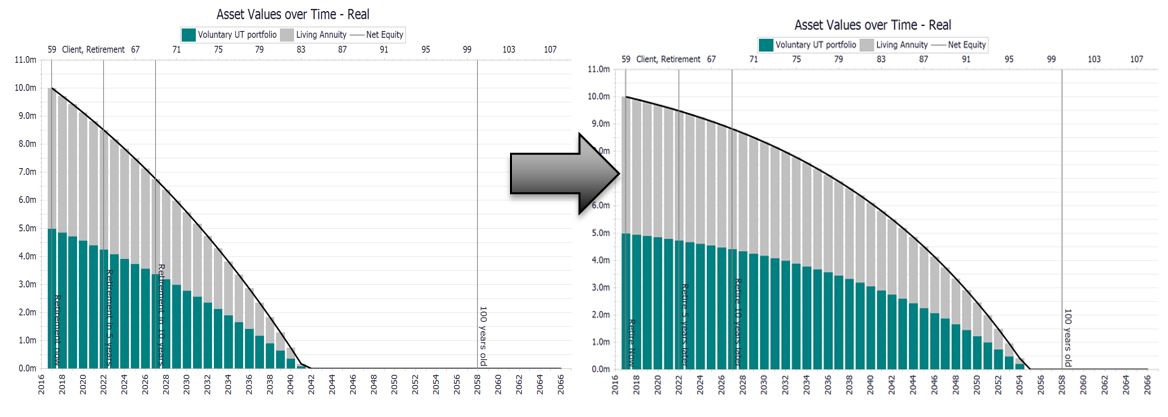

Investing too conservatively

We often see retirees de-risking investments at retirement to preserve their hard-earned savings. Without growth assets to track inflation, you will erode capital quickly!

What can you do?

The example below illustrates how you can extend the lifetime of your capital by increasing the overall risk of the investment portfolio. Diversification between asset classes locally and globally is important to achieve your long-term goals

Sequence risk

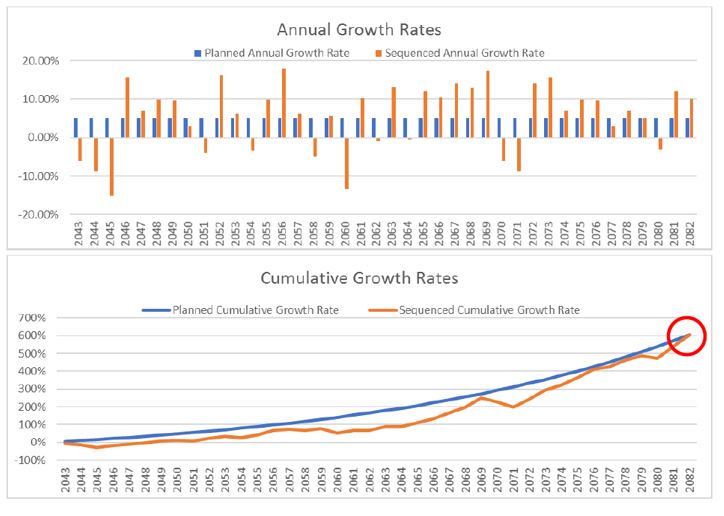

This is a risk not often spoken about or recognized by retirees, however it can have a substantial impact on your retirement. When we calculate what income you can draw in retirement, we have to assume what returns you will get from your investments going forward. We assume an average return each year (illustrated by the blue bars below). However, returns are volatile and don’t come in a straight line (illustrated by the orange bars).

More importantly, the ORDER in which you get these returns will impact the overall capital. Over the long term you may look back and see the average investment returns were in line with expectations BUT two different scenarios can have two different outcomes.

- Scenario A: First five years you experience returns higher than the average. In this scenario you may extend the lifetime of your capital;

- Scenario B: First five years you experience returns lower than the average. In this scenario you may reduce the lifetime of your capital.

What can you do?

The only way to deal with sequence risk is to adjust your income withdrawals through extended periods of low returns. You need to be flexible around your income. Therefore, distinguish between your needs, wants and wishes.

Poor advice and portfolio construction

We believe that the role of a financial advisor in identifying and mitigating these risks is crucial. Studies by Morningstar and Vanguard show that good advisors can add as much as 2-3% to returns per annum. These are some of the areas where significant value is added:

- Behavioural coaching: Set long-term strategic goals and help clients stay invested through market fluctuations;

- Tax efficient withdrawals and liquidity: Managing withdrawals from voluntary and compulsory investments efficiently;

- Dynamic withdrawal management: Income flexibility and budget guidance through periods of low returns;

- Efficient portfolio construction: Good portfolio construction is critical to achieve expected returns. Sophisticated asset allocation and fund manager selection is not easy and a skill worth paying for. To illustrate this, we share annualized five-year performance:

- The average return of all medium equity unit trust funds in South Africa: 7.4%

- Our client medium equity portfolios: 10.7%

It can be difficult to know how to counter these risks but we’ve shown you that it is possible once you have awareness of these risks. At Foundation, we believe that sound advice and working together before and after your retirement around withdrawal strategy and portfolio construction, can help our clients navigate these risks.

<Foundation Family Wealth is an Authorised Financial Services Provider>