A few months ago we took a bird’s-eye view of the different marital regimes in South Africa (read the article here). This month we’re focusing on marriages outside of community of property, with the inclusion of the accrual system. This seems simple on paper, but can get technical and confusing.

Out of Community: The Two Basics

Being married outside of community of property is commonly referred to as being married with an “ANC” (ante-nuptial contract). While the provisions of the ANC can be as detailed as you want it to be, it usually means that spouses keep the assets that they acquired before the marriage separate. In addition, spouses do not have a claim on those assets at dissolution of the marriage through divorce or death.

From here on (after the wedding, that is) there are two options:

- We share a home, but not a wallet. We continue to accumulate our own assets and keep our financial affairs separate. Our assets and liabilities are our own, equally so for profits and losses. At death the two estates remain separate.

- We build wealth together. We make accrual applicable – we each keep assets accumulated individually before the wedding, but share in each other’s assets accumulated during our marriage.

Anyone who entered into an ANC after 1984 is automatically married with the accrual system, unless accrual is specifically excluded.

Commencement values

When a couple includes the accrual system, they have to take note of what their estates are worth at the start of the marriage. This is called the commencement value. Both parties have to agree to these values at the start otherwise it can become a point of contention at a later stage (if either party disputes the commencement value of the other). Take divorce as an example – where one or both parties make a case that the spouse’s commencement value was overstated or completely incorrect. The larger the commencement value, the smaller the accrual, and the possible claim.

What is excluded from the commencement value?

Not all the receipts of funds and assets during the marriage will necessarily be included in the accrual calculation. This list includes:

- An inheritance received during the marriage from any third party;

- Donations between spouses;

- Payments for damages suffered by a spouse (e.g. lawsuits for slander);

- Any asset specifically excluded from the accrual system under the ANC;

- Future assets that you do not own yet, but this will have to be described in great detail.

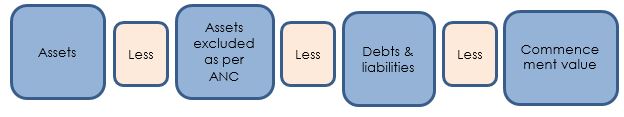

Calculating the Accrual Claim

When the marriage is dissolved by death or divorce, the net value of each estate is determined. The larger estate then has to pay half the difference to the smaller estate. The simple format for the calculation is:

The commencement value in the ANC is first adjusted for inflation to make provision for any change in the value of money since inception of the marriage.

Accruals and Estate Planning

Regardless of the possible impact at divorce, the accrual system is also significant in estate planning. An accrual claim is always calculated and implemented before the bequests in a will are carried out.

If one spouse dies (or both simultaneously), the accrual will be calculated. This could play out in one of the following ways:

- if the surviving spouse had the smaller gain, he/she will have a claim against the deceased’s estate, or,

- if the surviving spouse had the bigger gain, he/she will be forced to make a payment into the deceased’s estate.

In the first case, the surviving spouse’s accrual claim will rank behind other creditors, but ahead of heirs. This could mean that heirs are unable to inherit if the estate is illiquid or insolvent.

It’s important that the ANC and the will speak to one another so that there are no unintended complications. If there are not enough liquid assets in an estate, it’s worth investigating the possibility of a life policy that will provide extra liquidity to meet an accrual claim at death.

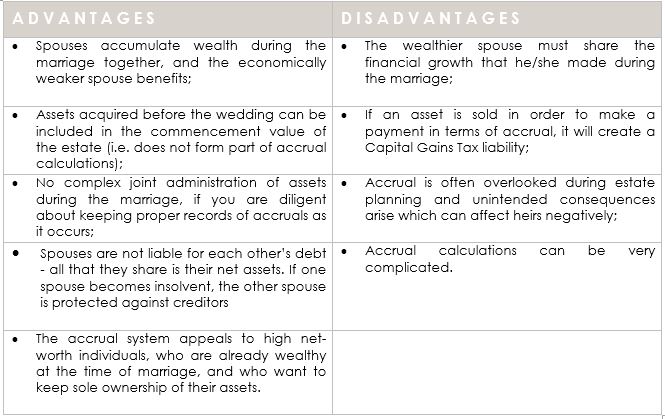

To Accrue or Not…

There is no simple answer to this! It’s not a question of “what’s right?”, or “what’s better?”

Consider this:

Whether or not you choose to include the accrual system will depend on your relationship and your specific needs. This is something that you need to decide as equal partners.

Important Boxes to Tick Off

- Do you have sufficient knowledge of the different marital regimes before you sign on the dotted line? Are you certain of the implications?

- If you opt for the inclusion of accrual:

- Agree and document the commencement values of your estates before the marriage;

- Set up a system where you can keep accurate track of accruals, as it occurs. Keep supporting documents.

- If you are already married with the inclusion of accrual, have you recently revised your estate planning to ensure that there is enough liquidity in your estate to meet the obligation of an accrual claim?

Foundation is able to assist with estate planning and accrual calculations. Contact us if you would like more information. Know the numbers and the possible shortfall while you can still plan and make provision for it.