Look

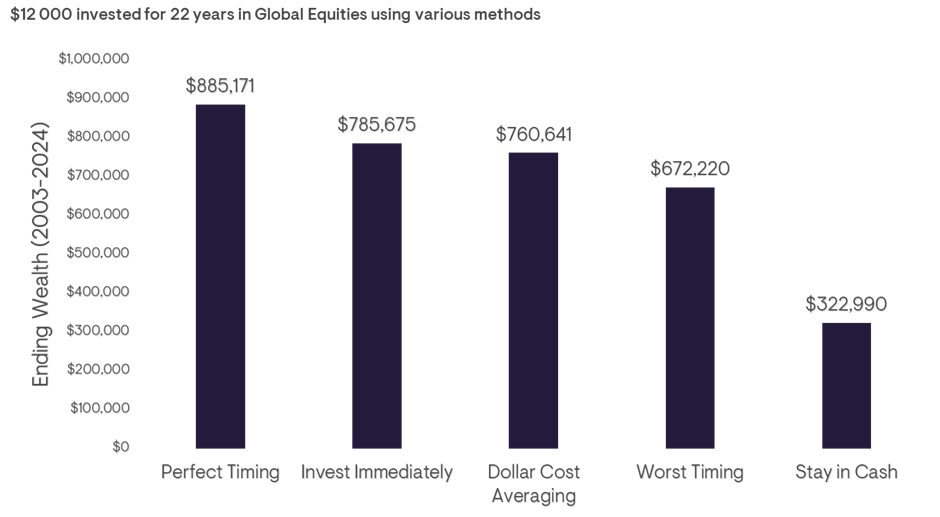

This graph shows the outcomes of investing $12,000 over 22 years using different strategies, from perfect timing to staying in cash.

Source: Schwab Center for Financial Research and Ninety One Calculations. Period 1 January 2003 to 31 December 2024.

It highlights that the results for most investment approaches are surprisingly close, except for staying out of the market entirely. It tells us that even if you don’t invest at the “perfect” time, being invested, either all at once or gradually, can deliver strong long-term results.

This is especially insightful during volatile markets like the one we are experiencing now. As advisors, we often find that uncertainty can lead to hesitation. For investors who feel nervous about investing a lump sum, a disciplined, gradual approach like dollar-cost averaging can make them feel more comfortable without sacrificing much returns.

Listen

In a recent episode of ReThinking with Adam Grant, renowned Harvard psychologist Dan Gilbert shares powerful insights into what truly makes us happy and why we often get it wrong. Drawing from decades of research, he explains that while we tend to overestimate the long-term impact of life’s challenges (like job loss or divorce), humans are far more emotionally resilient and adaptable than we expect. Surprisingly, the smaller annoyances, not the big setbacks, affect us most over time.

This conversation is valuable for anyone navigating meaningful life or financial decisions. It highlights the importance of thoughtful guidance, long-term perspective, and self-awareness.

What I took from the discussion is that good advice isn’t just about numbers but about helping us prepare for how we feel about the future. It’s an important reminder that things may turn out better and matter less than you think.

Learn

In The 5 Types of Wealth, Sahil Bloom redefines traditional notions of success by expanding the concept of wealth far beyond money. Bloom walks readers through five distinct forms of wealth (Financial, Social, Physical, Mental, and time) that he believes contribute to a fulfilling life.

How often does modern life trap individuals in the pursuit of money? Ignoring other vital areas that create genuine prosperity! Drawing from personal anecdotes, historical examples, and philosophical wisdom, Bloom crafts a narrative that encourages readers to reflect on what it means to live richly and meaningfully.

The book’s brilliance lies in its simplicity and practicality. He offers a blueprint for realignment: building financial resilience, nurturing authentic relationships, protecting physical health, cultivating a calm and curious mind, and reclaiming time as life’s most finite currency.

His holistic approach invites readers to audit their lives and make intentional changes beyond the bank account. Whether you are climbing the career ladder, navigating a life transition, or seeking purpose, The 5 Types of Wealth is a powerful reminder that the richest life is one lived with balance, clarity, and intention.

Ponder

In this section, I invite you to think about a question I may pose or a thought I may share.

How many folks, in country and in town,

Neglect their principal affair;

And let, for want of due repair,

A real house fall down,

To build a castle in the air?

-Poem by Jean de La Fontaine

Oenophilia

“Oenophilia simply refers to enjoying wine, often by laymen.”

I’ve shared my love for Pieter Walser’s wine and storytelling here before, but this one deserves a special mention because it is one of my favourite Grenache Noir wines. For those unfamiliar with BlankBottle, Pieter’s beautifully crafted wines all have a story to tell. This is the story about Familiemoord:

“In 2013, I released a wine called Familiemoord – a wine about the extraordinary but true story of how the police thought I killed my son and buried him in a shallow grave in the vacant property next to our house. The Cape Argus’ article on 11 May 2013 about the incident titled “The mystery of the boy in the sandpit” serves as this wine’s label.

Don’t worry, my son is alive and well and is turning 13 in September – 6 years after I “killed” him. This wine has generated the most reaction of any wine I have ever produced – and not for any of the reasons a winemaker would hope for. In fact, most people were totally oblivious as to the terroir (Swartland) or cultivar (Grenache noir) of the 2013 vintage! Some countries were uncomfortable with the name, so in 2015 I stopped producing it.

But now that the dust has settled Familiemoord is back.”

As winter rolls in, I lit my wood-burning oven for the first time this season and enjoyed the moment with my first bottle of Familiemoord ’23 for the season. Notes of Raspberry and Rooibos tea - this stunning Piekenierskloof Grenache will be a firm winter favourite.

Stay curious,

Elke Zeki