Look

Worldwide, inflation related headlines make for daily reading. But what exactly is inflation and how does it affect the financial and economic system?

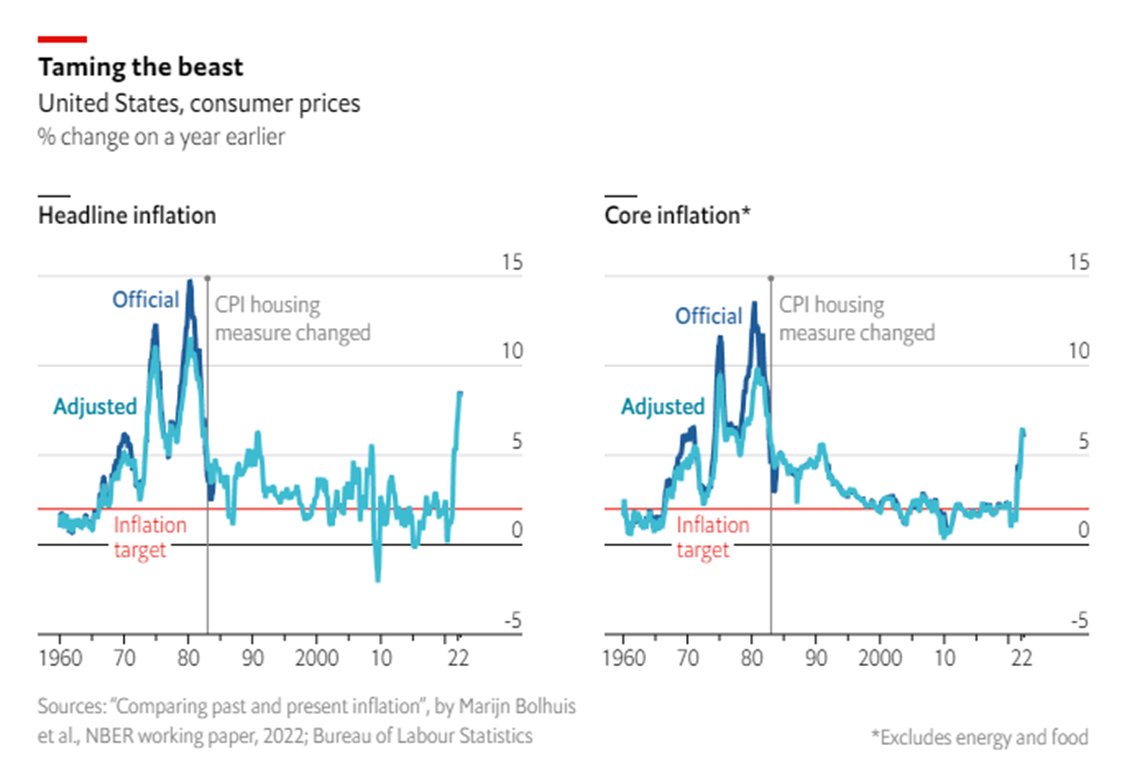

Source: The Economist

This visual guide explains that there are 3 types of inflation, each with its own effects and characteristics to consider:

- Monetary inflation – here, the supply of money in the economy increases (simply put, the government prints money). Recently, this was seen in the US, when money supply spiked dramatically due to government stimulus pumped into the market during the pandemic.

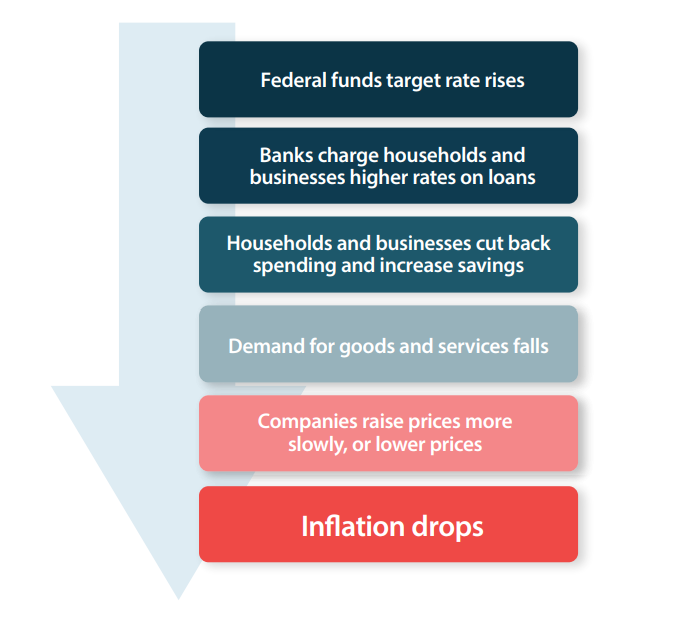

- Consumer price inflation – this is when the prices of goods and services rise. Consumer demand, supply chain issues or geopolitical factors, as well as monetary supply (above) may impact consumer price inflation. The higher consumer price inflation the more central banks tend to hike interest rates to reduce the demand for goods and services so that prices stabilise.

- Asset price inflation – this occurs when the price of stocks, bonds, real-estate, and other financial assets increase over time. Low borrowing costs often correlate with rising asset prices and strong consumer confidence. However, if asset prices rise too much it can indicate an asset bubble.

Inflation is complex. In South Africa and globally the most recent increase in inflation was fuelled by all three types of inflation - monetary, consumer price and asset price. Central banks responded to the rising inflation numbers by increasing interest rates (higher interest rates have historically led to lower inflation – illustrated below).

Why is inflation problematic?

High inflation makes it hard for people to plan their spending because of the uncertainty of price increases. It also erodes the value of their earnings and wealth. This is also true for businesses and therefore you find markets decline due to lower expected earnings.

So, what is the bottom-line?

The pain inflicted by interest rate increases is necessary for the long-term health of the global economy. However, in the short-term it will affect our pockets as interest rates increase. Uncertainty around the interest rate increases (i.e size and timing of hikes) may also lead to short-term volatility in the equity markets.

Listen

Nobel laureate and writer, Daniel Kahneman has transformed the fields of economics and investing. When asked what constituted an ideal advisor he said, “A person who likes you and doesn’t care about your feelings”.

One of our key value propositions is to keep our clients accountable to their own financial decisions. We strive to have meaningful conversations about their goals, values, and dreams. Sometimes these are difficult conversations. We don’t aim for them but sometimes it is unavoidable if we are to help clients realise their goals.

Having a difficult conversation with someone is not easy and emotions can easily detract from what you are trying to achieve. In this podcast, Sheila Heen’s perspective on difficult conversations was fascinating. We think difficult conversations are about persuading and talking but as Heen explains, it’s more about listening. Something that is especially hard to do when you are feeling frustrated or emotional. Sheila recommends leaning into the conflict to understand it better.

Sheila is a lecturer at Harvard Law school and specialises in negotiation and conflict resolution.

Learn

Many of our clients are parents or grandparents to young children and they often wonder how to talk to children about money. It is a crucial conversation because our attitude and behaviour towards money is often learnt and adopted from our own parents. Were your parents frugal? Did they save every cent, or did they spend the money they earned? Were both parents involved in financial decisions or was there only one decision-maker? Did they both work? All these factors influence the way you view money and how you behave today. And this will influence your children’s money behaviour. Having awareness around this and starting the conversation when children are young is great.

I find that many of our clients’ children grow up in privileged homes. It’s wonderful that they can experience the comforts and joy money brings to their lives. However, many parents worry that their children don’t understand and appreciate the efforts it takes to enjoy these privileges.

So how can you start this conversation and what are some of the things you can do to teach your children about money?

- I have found that the simple act of practicing gratitude and acknowledging the joy money brings teaches children from a young age to be thankful and appreciative. You cannot deny their privilege, but you can teach them to be grateful for it.

- Talk about the work you do. Children need to learn that it takes time and effort to earn money. Let them do small chores around the house before giving them money so that they can make this connection.

- Show them how to save. Even if they use some of the money they earned from a chore, encourage them to save some of the money for the future. Getting a piggy bank or moneybox is ideal.

Author and former colleague Gugu Sidaki wrote three wonderful books on money for children. She is a financial planner and is passionate about financial literacy for children. These books are based on the principals shared above and will help you start the conversation in a fun and interactive way.

I hope you enjoyed this month’s edition.

Stay curious,

Elke Zeki