Snippets and a short summary of what we are reading, listening and paying attention to.

Look

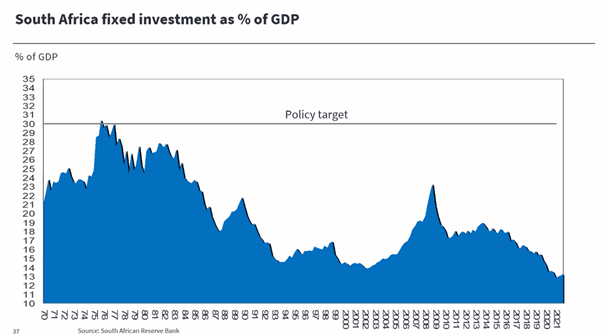

Headlines like this aim to create a sense of hope and achievement, yet it is filled with misinterpretation and false hope. Context is everything. To most of us, these numbers seem big and look like a positive thing! Yet, as a % of GDP, fixed investment into the South African economy is at an all-time low.

Source: Stanlib

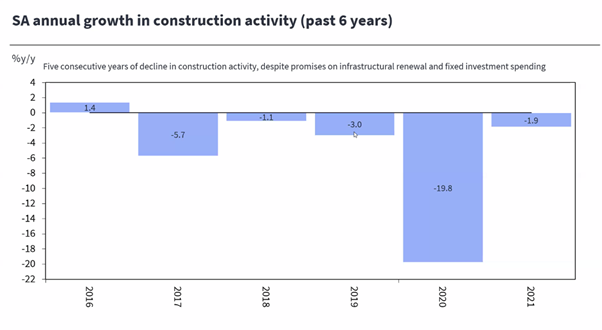

Sectors such as construction have, since 2017, been in a 5-year decline and are struggling to stay in business.

Source: Stanlib

Our employment numbers are still not back to pre-Covid levels.

Fixed investment and employment go hand in hand, and currently, both look dire. This signals one clear message according to Economist Kevin Lings, namely, that we don’t believe in ourselves and our ability to grow this country’s economy. In other words, there is a negative sentiment.

The government and media are not doing us any favours by giving false hope. It would be better if we had a clearer understanding and open communication about our problems, so we could address them in an open and systematic way. Seeing this is an election year within the ANC, I suspect we will be seeing a lot of misinterpretation and “noise” this year. Living in South Africa, hope is necessary if we are to rebuild our economy. Hope is what drives action. But let’s make sure we are not mislead by headlines so our actions are directed to the right place.

Listen

What leads us to buy insurance is not rational thinking its “magical” thinking. It’s the belief that if I have insurance, the things I fear will not happen to me. Yet the risk of your house burning down for example is the same for an insured and uninsured person. Yet insured people perceive their risk to be lower. This short talk about behavioural thinking and insurance is fascinating.

Learn

Uncertainty in the world is almost always reflected in the markets. Markets therefore move in cycles. Bear markets are part of a normal market cycle and are not something to fear. Global developed markets have been in a 13-year bull market. Rising interest rates and inflation together with the Ukraine war have put pressure on global markets since the start of 2022. Investors now fear that the tide is changing and that we might see a bear market going forward. When I speak to clients, I find that this causes worry and concern, yet it’s completely normal for markets to behave this way. We have to focus on long-term investment strategies and aim to keep our clients invested regardless of where we are in the cycle. This document by Hartford funds shares some perspectives and facts about bear markets that may help calm the nerves.

I hope you enjoyed this month’s edition.

Stay curious,

Elke Zeki