In January 2022, storm clouds gathered quickly when it seemed that Putin was set to go to war with Ukraine. When Putin’s forces did invade Ukraine, it set in motion a series of events that culminated in one of the worst years on record for ordinary global investors. It wiped out most of the euphoric post-pandemic overhang from 2021 and the gains in portfolios.

To be fair, inflation was already ticking higher due to a pandemic overhang, and expectations in financial markets had probably become too optimistic. The war was just the final straw that broke the camel’s back.

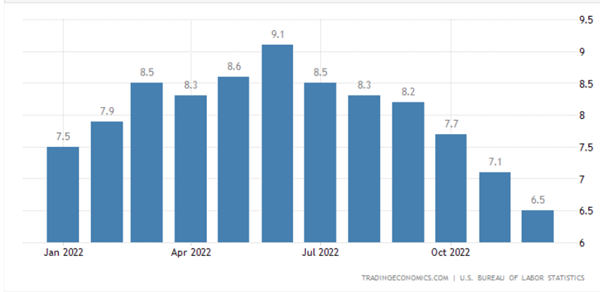

2022 became the year that we finally saw inflation return with a vengeance, and previously meek monetary authorities turned off the easy money taps.

Source: Tradingeconomics

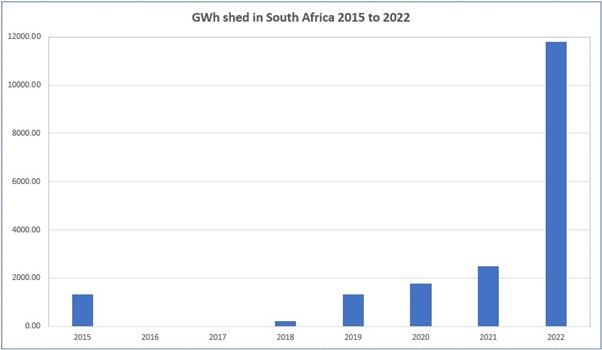

Closer to home, the most disheartening story may be electricity generation or the lack thereof by Eskom. The graph below shows the estimated unserved energy (GWh) due to load shedding by Eskom from 2015 to 2022 – the extent of the disaster is clear.

Source: EE Business Intelligence

Probably even more discouraging is the ANC government’s handling of the crises. In the lead up to the ANC’s election, Andre de Ruyter, the CEO of Eskom resigned when it became apparent that he no longer had the backing of key ministers. What is probably the most treacherous, but also most important job seat in the country right now, is now empty.

Surprisingly though, the South African economy eked out positive growth in the third quarter of the year. The economy expanded by 1.6% to just above pre-pandemic levels, with agriculture, transport, communication, and construction contributing to the positive outcome. Analysts calculate that loadshedding cost the economy a further 1.3% in growth.

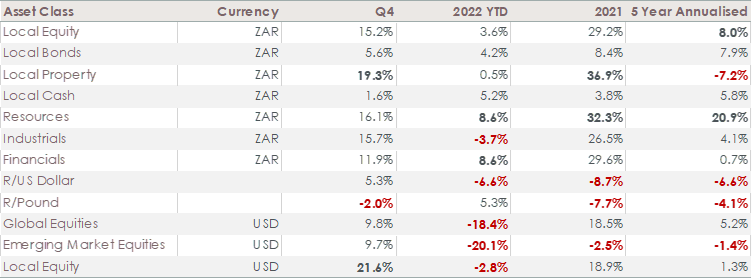

Source: PortfolioMetrix

Overall, the fourth quarter was a strong one for South African investors – local shares and property recovered by 15% and 19% respectively, to end the year in positive territory. Although resource shares contributed to most of the recovery, it is satisfactory to note that industrial and financial shares also delivered during the quarter.

Even a much weaker Rand could not cushion the blow for global equities over the last year for Rand investors. It is interesting to note that in a reversal of trends, the local equity market delivered 22% returns in USD over the last quarter compared to the 10% return from global equities. Over the year the local equity market was down by 3% compared to the 18% of global equities and 20% of emerging markets overall.

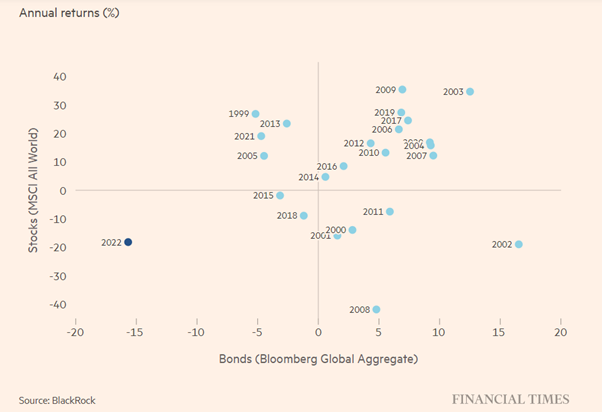

Just how poor was 2022 for investors? In an analysis published by the Financial Times, you can see the returns of the classical global share and bond portfolio. It is unusual for bonds and shares to deliver poor returns in the same year (there are only three points in the bottom left corner of the graph below). However, in 2022, global bonds and shares delivered extremely low, outlier returns.

Source: BlackRock

It ended a spectacular three-year streak for global equities, specifically when measured in South African Rands of 25%, 22%, and 33% respectively. Just when South African investors were sure that global equities were a safe bet, their faith was shaken.

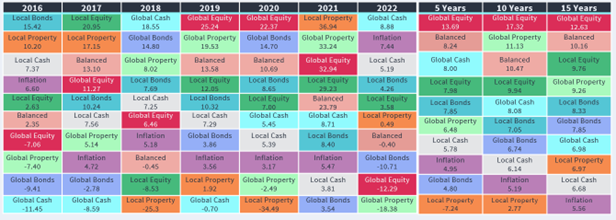

In the table below (known as the smartie box table in the industry), you can see that global equities delivered -12% in 2022, only beaten by global property’s -18%. It illustrates that we should always remain vigilant against recency bias – the tendency to place too much emphasis on experiences that are freshest in our memories.

Source: Morningstar, STANLIB Fund Research

Not surprisingly cash was king last year. However, no investment beats inflation once you have considered last year’s tax.

What to expect from 2023?

Monetary policy authorities are expected to continue to raise interest rates over the course of the year. The US Federal Reserve will lead by potentially another two hikes of around 25 basis points each.

The outlook for the global economy is growing gloomier, diminishing the prospects for companies to grow earnings and for consumers who are already stretched by the rising cost of living. Large-scale layoffs will dampen spirits further.

Inflation is unlikely to return to pre-pandemic levels soon. However, inflation will likely peak and start easing off towards the end of the year.

Rising interest rates and dampened economic growth or even recession are not associated with strong financial markets. However, we need to bear in mind that financial markets are always looking further ahead and will soon start anticipating the end of the rising interest rate cycle. Research by Bank of America shows that the S&P 500 on average gained 14% in the year following the end of interest rate hikes.

It points to a year of speculation about the end of the hiking cycle, with the resulting see-sawing of sentiment and even more than usual volatility. It also will be helpful to remember that economic growth and financial markets are not highly correlated in the short term – in general, economic growth will recover long after financial markets have anticipated the recovery.

South African investors may also take some comfort from the fact that our financial markets have not suffered from over-optimism and our policies have not been as expansionary. South African inflation could already have peaked. It may result in continued relatively strong returns for local markets.

<Foundation Family Wealth is an Authorised Financial Services Provider>