Look

We haven’t seen a Ponzi scheme in South Africa for a very long time, but last week a well-known investment professional, Craig Warriner from BHI Trust, handed himself over to authorities for investment fraud within his R2.6-billion-rand fund. The fraud has affected thousands of people.

It appears the fund lost a lot of money during the financial crisis in 2008, and since then he has been “using Peter’s money to pay Paul”. This admission from Warriner has left investors worried about the security of their funds and questioning whether they will be able to recover any of it.

The FSCA is currently investigating BHI Trust and “other persons” in the industry - presumably intermediaries that recommended this product to their clients.

As a passionate ambassador for the financial planning industry, this event saddens me deeply. We work tirelessly to ensure our clients' funds are invested appropriately, in line with their risk tolerance and objectives. We do due diligence on all funds recommended. We diversify investments to protect our clients against the unknown. We charge reasonable fees in line with our expertise and care. We always strive to do what is best for our clients. Fraudsters such as Warriner, undermine this and it has collateral. It breaks trust between financial advisors and clients collectively.

Each investor in BHI Trust will have a unique set of circumstances and it is not always easy to see something like this coming. However, this incident has reminded me that there are a few “red flags” we should always take note of. That should make us pause. Doing so may help protect us from the consequences of poor financial decisions:

- An upfront fee of 5% was charged. This is high by industry standards. An upfront fee usually comes with lock-in periods or cancellation fees. Ask yourself: if an advisor sells you a product and takes a fee upfront, are they incentivised to look after you going forward? We don’t believe so, which is why we don’t take upfront fees on any investments recommended to our clients.

- The investment was marketed as a low-risk investment, yet on closer inspection, it seems the underlying investment strategy was trading in a limited number of shares. Shares are an important part of a diversified portfolio but on its own are risky and volatile. It should and could never be described as low risk. Take the time to educate yourself on the basics of what a low-risk investment strategy is. Your advisor can help you with this, as can a quick search on Google.

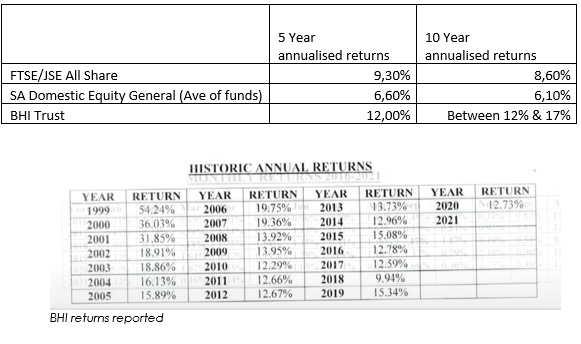

- Returns were too good to be true. All fund managers strive to beat the benchmark but be wary if returns are wildly out of line with the benchmark. For example, below is a breakdown of the returns reported to BHI Trust investors. The BHI Trust reported annualised returns much higher than what the equity market provided on average or what similar funds on average reported. It is not impossible to experience great returns year-on-year, but it’s certainly a red flag in my mind.

- The fund was not registered as a collective investment scheme. Licensed and registered funds are highly regulated, which provides a necessary level of protection. Check that your adviser has done their due diligence on the funds being recommended.

Clients look to investment professionals and advisors for guidance, and the fact that many clients were advised by such professionals highlights the flaws in our industry. Our industry will need to account for it. It is the only way we can safeguard our industry and our clients going forward.

There are still many unknowns about this case and investigations are underway. Accountable persons will have to face the fire. It will not be a comfortable time for financial advisors. But truth seldom is. If you have not had frank, honest conversations with your advisor, if you’ve not asked questions, probed, or had things fully explained, you should perhaps pause. Observe the “flag” that this is too.

Listen

Is uncertainty a barrier to success? As kids, we are always taught in exams to try and answer correctly. “I don’t know” is an unacceptable response and because of that, we grow up thinking it’s a weakness to not know. However, we live in an ever-changing and uncertain world.

Because we don’t want to appear weak, we seem to confuse confidence with certainty. Confident people give you the impression that they know what the outcome of something will be. I see this a lot in our industry. People gravitate towards fund managers and market commentators who seem to know what’s going to happen. Confidence gives people a sense of safety.

The problem is that confidence and certainty close you off to new information. If you are always certain about your beliefs, you lose the ability to look at other perspectives. Conversely, when you go into a space of “I don’t know”, you are opening yourself up to more information. It is in this space that you can invite collaborators. Improve your thinking. Grow.

Even though we are financial planning experts, we always invite our clients to collaborate with us. We do this because we believe the more information, we have the better the decisions that we make. In this video Annie Duke, a professional poker player and author, argues exactly this point: that not knowing and uncertainty are not barriers to success but in fact a driver of success.

Learn

Many years ago, we were privileged to host futurist and author Graeme Codrington for a client event, in which he discussed his book Mind the Gap. Codrington talked about the remarkable influence the decade or era into which you are born has on your life. It affects the way you think about money, relationships, parenting, and work.

During Graeme’s session, I recall the crowd chuckling at their generational behaviours and beliefs. We could all relate to the idiosyncrasies that made each generation unique. Codrington referred to the differences as gaps. Sadly, these generational gaps are not given much thought and often cause misunderstandings and conflict in relationships.

Psychology professor Jean M. Twenge likewise says that the decade in which you were born has a larger effect on your personality than the family who raised you.

Her recent book, Generations: The Real Differences Between Gen Z, Millennials, Gen X, Boomers and Silent’s – and What They Mean for America’s Future, is the culmination of years of research and survey data. It is a book that brings us wonderful, surprising insights, that can strengthen the quality of our personal and professional relationships.

Oenophilia

“Oenophilia is a love of wine. In the strictest sense, oenophilia describes a disciplined devotion to wine, accompanying strict traditions of consumption and appreciation. In a general sense, however, oenophilia simply refers to the enjoyment of wine, often by laymen.”

This month I bring you one of the most unique and interesting wine makers in South Africa. Pieter Walser from Blank Bottle - a winemaker who has but one goal! That is to encourage anyone drinking his wine to judge it based on what is IN the bottle and not by any preconceived ideas related to what’s printed ON the bottle.

Labels will not tell you the varietal, and neither will the bottle shape and size. You wouldn’t know if you are drinking a Chenin, Chardonnay, or Cinsault without the label. Walser is not afraid to bottle a Chenin Blanc in a long thin bottle - typically used for Rieslings or dessert wines - which is all part of the fun and enjoyment of drinking his wines.

But most importantly, Walser is not just a talented winemaker but a gifted storyteller. Each bottle has a carefully designed and sketched label (by Wasser himself) with a QR code, that when scanned will take you on a journey that no other winemaker does.

I invite you to enjoy the remarkable story and wine called Little William.

This wine is a wonderful Shiraz with notes of red currant and cranberry, white pepper, and spice! Great with your next steak or fillet on the braai.

I hope you enjoyed this month’s edition.

Stay curious,

Elke Zeki, CFP®

//03 November 2023