Look

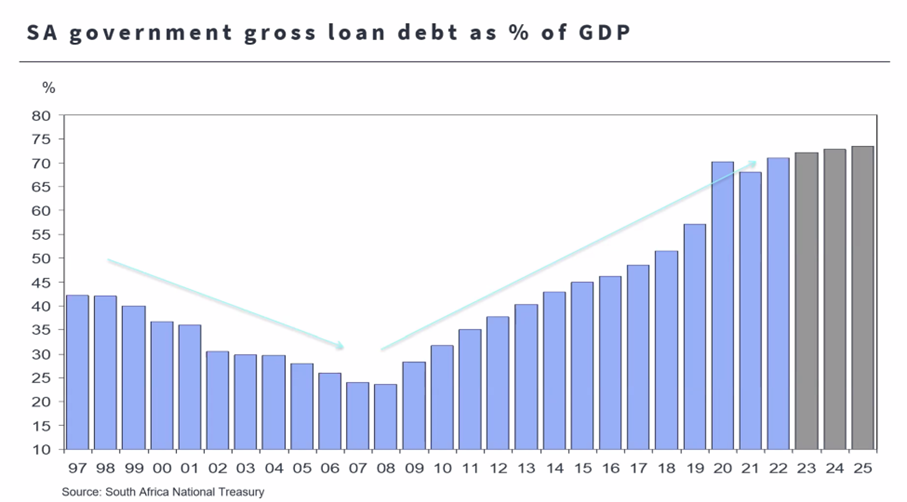

The role of corporates in South Africa remains challenging as sentiment is low. One of the factors adding to poor sentiment is our country’s fiscal deterioration as our government is highly indebted. This means that our government is spending more than it is collecting in tax revenue. The reason tax collections are lower than projected is that our economy is not growing, and business profits are lower.

How the Minister of Finance, Enoch Godongwana, addresses this in the coming budgets will be key. It’s unlikely that Godongwana will open the purse strings to spending. He might even consider increasing taxes (which will be very unpopular before the elections).

Although the indebtedness is concerning, it’s more important for this deterioration not to set in. Godongwana therefore has some important decisions to make.

What we also need to understand is that we cannot solely rely on the government to help this economy grow, although they play a big part in growth, there is simply no room for additional spending.

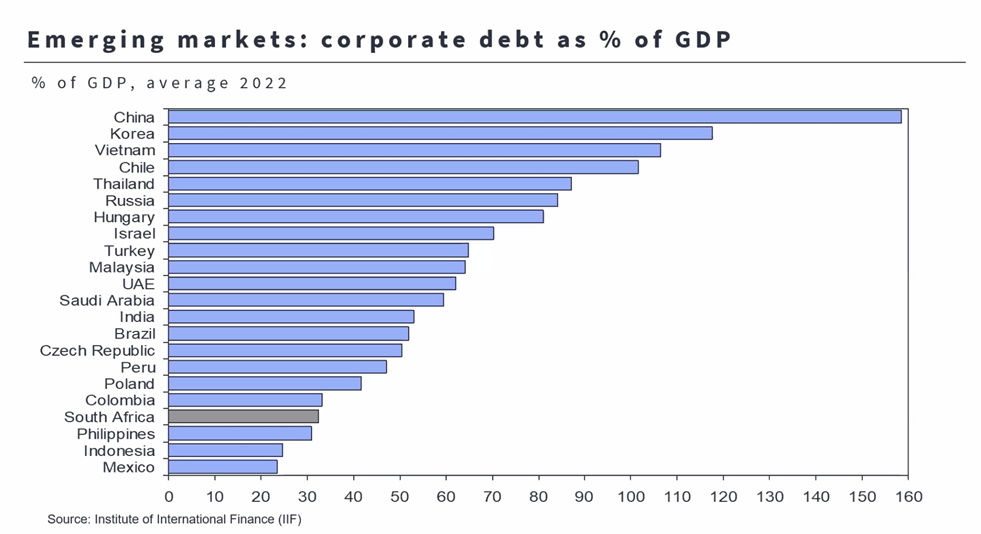

Corporate SA is however in a much stronger position. Corporates in South Africa have relatively low levels of debt relative to other countries. Although our economy is not growing, many corporates in South Africa are sitting on a substantial amount of cash. Because of negative sentiment, they are not reinvesting this cash into the economy.

However, this cash is our only hope if we are to unlock growth in South Africa. We are seeing some traction with private sector involvement in certain areas such as solar power generation. It’s crucial that the government continues engaging with the private sector and that it puts the right policies in place. Only then will corporates respond.

Listen

Ray Flemings has years of experience solving the most complicated problems for ultra-high-net-worth individuals and families. In this fascinating talk, Ray explains how his company, Myria, provides an exclusive concierge service to fewer than 100 of the world’s elite. Ray shares how the wealthy think about money and success. He discusses the challenges wealthy individuals face and how they raise and talk to their children about money.

These are complex and interesting topics that we often think about at Foundation. Most importantly this conversation helped me reflect on the difference between being rich and wealthy. Being rich means having cash flow, but being wealthy goes beyond money as it includes meaningful relationships, connections, and health.

Learn

The notion of halting or reversing aging, akin to the Peter Pan fantasy of eternal youth, has been a subject of fascination and research for centuries. In recent years, advancements in biotechnology, genomics, and other fields have indeed made significant strides in understanding and potentially delaying the aging process. Millions of dollars are flowing into this industry and watching this video from the latest Economist, reminded me that scientists are making headway.

We often plan for clients to the age of 100, even though life expectancy is still much lower. We believe planning for longer, however, gives you more freedom and choice when it comes to making financial decisions later in life.

As financial planning experts, I think it’s important to stay close to these developments as the implications will be immense. It will not just affect our financial planning, but our work and social lives may be very different.

What if living to 120 becomes our reality? Do we want to be like Peter Pan? It appears that many people do.

Oenophilia

“Oenophilia is a love of wine. In the strictest sense, oenophilia describes a disciplined devotion to wine, accompanying strict traditions of consumption and appreciation. In a general sense, however, oenophilia simply refers to the enjoyment of wine, often by laymen."

This month I walked the Pondo Trail with 21 strong and inspiring women. For most, our paths crossed again after studying at Stellenbosch more than 20 years ago. Now, many years later we got to share an experience of a lifetime. We hiked 65km over four days, in one of the few remaining untouched areas in SA – Pondoland (the first 100km of the Wildcoast, just south of Port Edward). We laughed until we cried, we stopped at every shebeen and swam in every rock pool we could find. When I returned, I felt lighter and filled with gratitude. Isn’t it amazing what nature and connection can do for the soul?

After a long day of walking, we were always greeted on the beach by our hosts with warm cloth, music, fire, and a gin. I also took a few bottles of my favourite summer wine, Rall Methode Ancestral Cinsault Rose, to enjoy on the beach with these special friends. This light fizzy cinsault is a wonderful and interesting alternative to MCC (Method Cap Classique).

I hope you enjoyed this month’s edition.

Stay curious,

Elke Zeki, CFP®

//04 October 2023