Look

For many South Africans, the recent weakness of the Rand is a big concern.

The Rand is the 18th most traded currency in the world, ahead of larger emerging economies such as Brazil, Poland, and Thailand. This makes it highly tradeable, but also very volatile as SA-specific issues affect the currency - although other global non-SA-related issues also affect the exchange rate as traders use our currency as a proxy for emerging markets.

This time around, our currency has weakened more than other emerging markets. This suggests that SA-specific issues, like loadshedding, are currently the biggest factors impacting the weakening of our currency.

A floating exchange rate is determined by the private market through supply and demand. A fixed, or pegged, rate is a rate the government (central bank) sets and maintains as the official exchange rate. The Rand is a free-floating currency; thus, it is doing what it should be doing to compensate for our relative lack of competitiveness in the world. The more loadshedding, we have, the higher our costs, the less competitive our exports, and the more we rely on imports and that weakens the Rand.

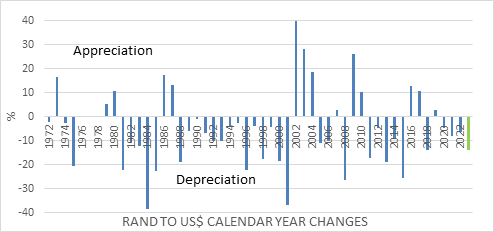

It is important to remember, however, that the Rand has blown out many times in the past (see graph below), and history suggests that we can recover from these levels.

Source: Refinitiv Datastream

How does this influence our investment approach?

At Foundation we have a large and growing exposure to global investments for most of our clients. Because of the political and economic risks, we fundamentally believe our clients should continue externalising funds, over time, to reduce their exposure to South Africa. Furthermore, global markets offer more investment opportunities and better portfolio diversification.

Because global equities have a long investment horizon, shorter-term currency fluctuations and market valuations are less relevant when investing. Having said that, they are still factors to consider when entering a market in times of unprecedented volatility, like now.

A weak currency is unlikely to bail you out if you bought into an expensive overseas market. If you sold cheap rands to buy expensive dollar equities, it can be a double whammy, as the rand recovers, and the equities underperform. Current valuations suggest that global markets are overvalued relative to South African markets. This is an expensive lesson many investors learned in the early 2000s, which we’d do well to learn from.

So, to summarise:

- It’s important to externalise funds but be careful of knee-jerk reactions in times of high volatility.

- Be disciplined in your approach (this helps remove the emotion).

- Diversify.

- Think long-term.

Listen

This month I’m sharing an old favourite of mine, a talk by author Brené Brown on The Anatomy of Trust. It has given me insight that has shaped the way I think about trust.

I had a difficult discussion with a client this week, which made me reflect on what it means to be trusted. Trust is something someone gives you. It’s a response to being trustworthy. You cannot control whether someone will give you their trust, but you can control how trustworthy you are.

Brown uses a wonderful acronym that describes the elements of trust. It might be useful thinking about these elements when considering how trustworthy you or your organisation is.

BRAVING

1. Boundaries: Do you have clear and kind boundaries?

2. Reliability: Do you do what you say you will do?

3. Accountability: When making a mistake, do you own it, apologise for it, and make amends?

4. Vault: Do you hold someone’s confidence?

5. Integrity: Are you practicing your values and not just professing them?

6. Non-Judgement: How do you judge others or yourself?

7. Generosity: How generous are you in your assumptions of others?

I have found it to be worthwhile to think about the role trust plays, in my personal and professional relationships.

Misinformation, political polarisation, and institutional and government failures are a few examples of factors that lead to society being less trusting. These factors can be overwhelming, and I think we should remind ourselves to focus on what we can control. Focus on your own trustworthiness. Can you show adequate, useful, and simple evidence that you are trustworthy? I’m hoping Brown’s work can help you reflect on this.

Learn

I recently had the privilege of hearing Paddy Upton speak at a financial planning conference. Paddy is a world-renowned cricket coach and author of the book The Barefoot Coach: Life-changing Insights from Coaching the World’s Best Cricketers.

You may wonder what a bunch of financial planners can learn from a cricket coach, and the answer is more than we could have imagined. Paddy shared insightful leadership and coaching lessons from his expansive career, that we can apply to many of our own business and personal interactions. However, my biggest take from his learnings was his focus on health and how it's connected to our financial planning world. He warned us that “there is no wealth without health!”

This is something I feel very passionate about. While financial planning often focuses on saving, investing, and managing risks, one critical element many tend to overlook is health. Health is and should be, a critical pillar in financial planning.

Consider this: no matter how much wealth you accumulate, it won’t matter if you're too ill to enjoy it. Medical costs can deplete your savings swiftly and unexpectedly, undermining years of careful planning. A good financial strategy, therefore, needs to include a health plan – this includes taking care of one's physical health to prevent unforeseen costs, and including health insurance to cover potential medical expenses.

Furthermore, it's not just about the potential cost of medical care; poor health can impact your income potential as well. Chronic health conditions can limit your ability to work, potentially leading to early retirement or disability, which in turn, limits your capacity to earn and save.

So how do we make health a priority in our financial plan? It starts by acknowledging that health is an investment, just like bonds, equity, or property.

Paddy refers to The Big 5 focus areas that will make a significant impact on your overall health and life.

1. Sleep

2. Nutrition

3. Exercise

4. Stress management

5. Quality of your relationships

It's crucial to recognise that maintaining and improving your health is a vital part of your financial planning strategy. Taking care of your physical well-being is a long-term investment that will pay dividends in terms of higher earning potential, lower healthcare costs, and a better quality of life in your golden years.

Oenophilia

“Oenophilia is a love of wine. In the strictest sense, oenophilia describes a disciplined devotion to wine, accompanying strict traditions of consumption and appreciation. In a general sense, however, oenophilia simply refers to the enjoyment of wine, often by laymen.”

It’s impossible to pinpoint my favourite wine. It’s like asking if I have a favourite child. But the reality is that I do prefer a certain style of wine, and if I had to choose my favourite varietal, it would be Pinot Noir. Pinot Noir is very special for many reasons, but here are a few:

1. It has complex aromas and flavours yet remains elegantly light-bodied.

2. It’s very sensitive to the environment it’s grown in and therefore is notoriously difficult to cultivate and grow. It often produces much lower yields than other varietals (this explains why it’s more expensive than other wines).

3. It’s very versatile when it comes to food pairings. It’s a red wine, but some wine lovers think it behaves more like a white wine. Therefore, it pairs beautifully with a wide variety of foods.

4. Quality wines have great aging potential.

Undoubtedly, the best producers of Pinot Noir in South Africa all sit in the Hemel-en-Aarde valley, just outside Hermanus. The climate and terroir support this grape beautifully and you can pick up a bottle from almost any farm in the area knowing it will be great!

My favourite Pinot Noir wines come from Crystallum, Storm Wines, Creation, Bouchard Finlayson, and Newton Johnson. Their flagship wines can be very expensive but, in my view, still offer better value for money than most French (Burgundy) wines.

Next month I will stick with this theme and share some affordable pinot noir options to try.

I hope you enjoyed this month’s edition.

Stay curious,

Elke Zeki, CFP®